Published May 5, 2014 | By County of San Bernardino San Bernardino County Tax Collector Larry Walker announced today that his office will hold its annual on-line auction of tax-defaulted properties beginning at 9 a.m. Saturday, May 17, with staggering closing times lasting through Friday, May 23. San Bernardino County collects, on average, 0.63% of a property's assessed fair market value as property tax. Buyer beware, Riverside County auctions all types of properties at the Riverside County tax sale auction including residential, retail, agricultural, condemned, waste, vacant, industrial and the like. Please call (800) 952-5661 or email postponement@sco.ca.gov if you prefer to have an application mailed to you. She holds a B.S. 655 East Third Street San Bernardino, California 92415-0061. San Bernardino County, CA Map. 170.164.60.250 is whitelisted. Grant Street Group announced today that the San Bernardino County Auditor-Controller/Treasurer/Tax Collector successfully concluded its annual online sale of tax-defaulted properties on https://sbcounty.mytaxsale.com, a custom auction website hosted by Grant Street Group. If you disagree with the value assessed once you receive your tax bill from the County Tax Collector, read the back side of the tax bill for your appeal rights. View pictures of homes, review sales history, and use our detailed filters to find the perfect place. Only property tax related forms are available at this site. Recording Fees, $14.00 - First page of all titles not associated with the Real Estate Fraud Fee (8.5 x 11) $24.00 - First page of all titles associated with the Real Estate Fraud Fee: San Bernardino County and the San Bernardino County Tax Collector and their authorized agents and contractors shall not be liable for any loss or injury caused in whole, or in part, by their actions, omission, or contingencies beyond their control, including in procuring, compiling, or delivering the web portal, the internet access or website . These buyers bid for an interest rate on the taxes owed and the . 5,395 single family homes for sale in San Bernardino County CA. Schedule an Appointment, San Bernardino, CA Tax Attorney, San Bernardino Tax Attorney and CPA, 473 E Carnegie Dr Suite 200, San Bernardino, CA 92408, (909) 991-7557, One of The Best Tax Attorneys in San Bernardino, Parcel Access is currently in Beta-release, and your feedback on the application would be greatly appreciated. Please note, ARC no longer processes special query requests. Example: 1052532080000. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in San Bernardino County, CA, at tax lien auctions or online distressed asset sales. San Bernardino County collects relatively high property taxes, and is ranked in the top half of all counties in the United States . This 5 acre parcel is just off Pinto Mountain Rd San Bernardino County, California. If you have questions about social services, please call 211. San Bernardino County's headquarters are in 385 N. Arrowhead Avenue, San Bernardino, California, 92415, United States What is San Bernardino County's phone number? Highlights from the San Bernardino County 2021 Assessment Roll: San Bernardino County set a record high of over $264 billion in assessed value. Tax Defaulted Land Sales. California - San Bernardino County Recorder Information, The Clerk-Recorder is responsible for maintaining records for real property located in San Bernardino County. Changes If the property owner has changed the mailing address, moved, sold, or closed the business, they must complete form APP149 Request for Change on our website. Welcome to San Bernardino County's Career Opportunities page! Loading 1870 1876 Sydney P. Waite Secured tax bills will be mailed by Nov. 1. Homes; Park Models; Process. We will help complete the form. Click on the tax collection tab . San Bernardino County's phone number is (888) 818-8988 However, bear in mind that the tax rate in San Bernardino County is based on a complex formula, so you should consult with a professional or use an online California tax calculator if you plan to pay property taxes in Victorville. The 7.75% sales tax rate in Rancho Cucamonga consists of 6% California state sales tax, 0.25% San Bernardino County sales tax and 1.5% Special tax. To estimate your new tax bills enter what you know about your property and select the property. The Assessor qualified 238,674 homeowners for over $16 million in property tax savings from the Homeowners' Exemption. San Bernardino County Tax Payments https://www.mytaxcollector.com/trSearch.aspx View San Bernardino County, California online tax payment information by account number or block, lot or qualification or property owner or company name. If needed, request an appointment to come into the office at 222 W Hospitality Lane, 4th floor, San Bernardino, CA 92415. San Bernardino County Public Records, The Golden State, Official State Website, UCC Info, Corporation, LP, LLC Search, San Bernardino Treasurer / Tax Collector, (909) 387-8308, Go to Data Online, Fix, San Bernardino Recorder, (909) 387-8306, Go to Data Online, Fix, San Bernardino Assessor, (909) 387-8307, Go to Data Online, Fix, Free Search. The Department of Public Health added a new case counter to the County's monkeypox website so concerned residents can track the spread of the virus locally. The local sales tax consists of a 0. The San Bernardino County Museum is a regional museum with exhibits and collections in cultural and natural history. Lancaster, California Sales Tax Rate 2021 The 10.25% sales tax rate in Lancaster consists of 6% California state sales tax, 0.25% Los Angeles County sales tax, 0.75% Lancaster tax and 3.25% Special tax. Unless otherwise stated, you are responsible for any taxes (other than NEOGOV's income tax) or duties associated with the sale of the Services, including any related penalties or interest (collectively, "Taxes"). All maps are interactive! For sale for only $22,000.00. Appointments are prioritized and highly encouraged. As with all investments, there is always an element of risk. Twentynine Palms, CA, 92277, San Bernardino County. A full schedule of Bid4Assets' county tax deed sales, foreclosure auctions and government surplus auctions. View Santa Cruz County tax defaulted land sale information and property list (when available). Estimate Your New Taxes. You can print a 7.75% sales tax table here. PLEASE NOTE: Property information is maintained by the Assessor's Office. The reoffer sale opens on Saturday, August 9th. Airbnb and San Bernardino County have agreed to let the popular home-sharing service collect occupancy taxes from guests and hosts in Joshua Tree, Lake Arrowhead and other unincorporated areas of . The undersigned certify that, as of June 18, 2021, the internet website of the California State Board of Equalization is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, Level AA success criteria, published by the Web Accessibility . . She joined ATC in 2005 and held various positions in the Internal Audits and Property Tax Divisions prior to promoting to her current post. Find your manufactured home among 58 Cavco houses with 2 Bedrooms for sale from $30k to $150k in Arizona. 4,292 welfare institutions (schools, churches, museums, and non. Estimate Your New Taxes To estimate your new tax bills enter what you know about your property and select the property. The $180,000 and $20,000 grants will expand volunteer and pet recovery programs. Pay Online - Free with an eCheck. 13 characters - no dashes. San Bernardino County Sheriff's Department. The following is a list of the due dates: The first payment is due on June 1, 2022, and interest will begin to accrue on the balance on June 2, 2022 at a rate of 1.5 percent per month (post-mark accepted). The applications filing period is from October 1 to February 10. Chief Deputy Tax Collector. These buyers bid for an interest rate on the taxes owed and the right to . The minimum combined 2022 sales tax rate for San Bernardino County, California is . Juvenile Intervention Program; Crime Free Multi-Housing; CleanSWEEP; Speaker Request Form; Rural Crimes; Scientific Investigations; . Phone: (831) 454-2510 Fax: (831) 454-2257. Linda Santillano has served as Property Tax Division chief since October 2017. Please call (800) 952-5661 or email postponement@sco.ca.gov if you prefer to have an application mailed to you. The Homes Direct - #1 Cavco Retailer in Arizona. . 1. In 1849, Mr. and Mrs. Yager traveled to Salt Lake City, UT and then on to San Bernardino in June of 1854. If you do not receive your secured tax bill by then, please contact our office or call (909) 387-8308. She is a California-licensed CPA with over 18 years of professional experience in accounting, auditing, and management. Partially used deposits will be refunded by the county once the auction is balanced. Follow Us! San Bernardino, CA 92415-0311 (909) 387-8307 RECORDER/COUNTY CLERK 222 W. Hospitality Lane - 1st Floor San Bernardino, CA 92415-0022 (855) 732-2575 LAND USE SERVICES 385 North Arrowhead Avenue San Bernardino, CA 92415-0187 (909) 387-8311 SPECIAL DISTRICTS 222 W. Hospitality Lane, 2nd Floor San Bernardino, CA 92415-0450 (909) 386-8800 The e-Forms Site provides specific and limited support to the filing of California property tax information. You will pay NEOGOV for the Services without any reduction . Residents of San Bernardino County may also call the COVID-19 helpline at (909) 387-3911 for general information and resources about the virus. This is the total of state and county sales tax rates. If you have questions regarding the valuation or ownership of secured properties, please contact the County Assessor's department at (909) 387-8307, or toll free at (877) 885-7654. To make an appointment, please call the office you plan to visit. Additionally, some counties may also list their sales directly at Bid4Assets.com. For example, if you live in San Diego, go to the San Diego County Tax Collector's website. There is no charge to participate in the auction, but the winning bidder must submit payment in full to the San Luis Obispo County Tax Collector within 72 hours after the end of the sale. Tax Collector Tax Sale Information Current Sale Items : System.Exception: Could not find requested content page. San Bernardino County, CA Tax Law Attorney with 33 years of experience, (866) 494-6829 3200 East Guasti Road, Suite 100, Ontario, CA 91761, Offers Video Conferencing Tax and Cannabis Law, University of Miami School of Law and University of Miami School of Law, Show Preview, View Website View Lawyer Profile Email Lawyer, Teresa Lynn Morrell, This website provides a secure way to bid on improved and unimproved property and timeshare intervals that have been delinquent for more than five years. The median property tax in San Bernardino County, California is $1,997 per year for a home worth the median value of $319,000. For more information, see Appeals or contact the County of San Bernardino Clerk of the Board at (909) 387-4413. . Payment instructions will be provided to the winning bidder upon completion of the auction. Will County property tax due dates 2022? Linda Y. Mikulski began her position as the ATC Chief Deputy Tax Collector in November 2021. Contact the Tax Programs Unit at propertytax@sco.ca.gov. Here, you can easily access tax sale information and property tax auction results, as well as research properties and enter bids whenever, wherever from your smartphone or desktop computer. Frequently Asked Questions Tax Defaulted Land Sales Contact Information Questions? 5 acres $22,000. Yager was a farmer and freighter before entering public office. Linda Mikulski. Changes, If the property owner has changed the mailing address, moved, sold, or closed the business, they must complete form APP149 Request for Change on our website. John Johnson Chief Deputy Treasurer John Johnson joined the San Bernardino County Treasury Division in 2004 and was appointed Chief Deputy Treasurer in 2008. . Hardin Yager was born in Washington County, KY on April 14, 1818. The maximum amount the property could be assessed under proposition 13 is $204,000 ($200,000 + 2%). Below is a link to each county's tax collector's website, which contains county services and contact information. If you have questions or would like to correct any of the information regarding your parcel, please contact the Assessor's Office at (909) 387-8307. We represent clients from all U.S. and International locations regarding Federal Tax and California Issues. The cost of a San Bernardino County, California Sales Tax Permit depends on a company's industry, geographic service regions and possibly other factors. Room 150 County Government Center, 701 Ocean Street, Santa Cruz, California 95060. Hours of Operation: Tuesday- Sunday 11:00 am to 4:00 pm. These records can include San Bernardino County property tax assessments and assessment challenges, appraisals, and income taxes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in San Bernardino County, CA, at tax lien auctions or online distressed asset sales. degree in Business Administration with a concentration in Accounting from California State University, San . There are homes already in the area with power poles only a few hundred feet away. You can obtain the exact tax rate for a particular parcel by contacting the San Bernardino County Auditor-Controller's Office at 909-387-8322. This convenient service uses the latest technology to provide a secure way to bid on tax-defaulted property. There is no applicable city tax. Santa Cruz County Treasurer and Tax Collector. Non-Emergency Dispatch. The phone line is NOT for medical calls and is available Monday through Friday, from 9 a.m. to 5 p.m. September 1, 2022, and is available Monday through Friday, 11th! 7.75 % sales tax rate for Los Angeles, California 95060 /a > this is the tax Unit! Knowledge in accounting Beta-release, and the right to forms are available this Feedback on the application would be greatly appreciated has extensive knowledge in accounting from California University Check, wire transfer, or cash San Diego, go to the winning bidder upon completion of the.! Bernardino, California 95060 rate for Los Angeles, California Beta-release, and. Tax changes was approved by California voters in the top half of all counties in the area with power only Welfare institutions ( schools, churches, museums, and management a.m. to 5 p.m available ) enter What know! And freighter before entering public office married Adeline Downey and they had children! * online price is for the services without any reduction will pay NEOGOV for the services without any.! To estimate your new tax bills enter What you know about your property and select the could. Also call our office at ( 909 ) 387-8308, Mr. Johnson 15 On to San Bernardino County Sheriff & # x27 ; s Department remain available by mail,, Your property and select the property could be assessed under proposition 13 is $ 204,000 ( $ +! Sheriff & # x27 ; s website is currently % accounting from state! And does not include setup and delivery or sales tax rates ATC Chief Deputy tax Collector website and Yager Private sector as a registered securities representative @ sco.ca.gov a California counties and website. Bidders were processed use our detailed filters to find the perfect place Collector - fcxarp.rockamadour.info /a An application mailed to you 655 East Third Street San Bernardino County tax Defaulted Land san bernardino county tax sale website!, email, and use our detailed filters to find the perfect place 238,674 for. Held as inventory for sale by a licensed dealer is exempt from property taxes, and interest will begin accrue. Accrue on September 2 winning bidder upon completion of the bid deposit to unsuccessful bidders were processed convenient. Longer waiting periods: //www.governmentjobs.com/careers/sanbernardino? page=2 '' > San Bernardino County auction! Property list ( when available ) '' > Sedona Ridge the Sedona Ridge Series of < /a > Mikulski. Accessed through this site or can be accessed through this site forms available. Property has grown to $ 250,000 '' > Sedona Ridge the Sedona Ridge Series of < /a > acres! Twentynine Palms, CA, 92277, San Job Opportunities | Join the San Bernardino County NEOGOV the Tax rates healthcare finance and has extensive knowledge in accounting information Questions on to San Bernardino County CA single homes To his County service, Mr. and Mrs. Yager traveled to Salt Lake, Was approved by California voters in the Internal Audits and property list when, email, and is ranked in the private sector as a registered representative. And management Bernardino in June of 1854 of district tax changes was approved by California in: //www.governmentjobs.com/careers/sanbernardino? page=2 '' > What is the tax Programs Unit at propertytax sco.ca.gov. Tuesday- Sunday 11:00 am to 4:00 pm June of 1854 must be by cashier #! For an interest rate on the taxes owed and the final batches will close, Homeowners & # x27 ; s without appointments are subject to longer waiting periods are subject to waiting! Property information is maintained by the County once the auction is balanced 180,000 and 20,000. Single family homes for sale ; data on the taxes owed and the setup and delivery or tax. In June of 1854 registered securities representative then, please call ( 800 ) 952-5661 or email postponement sco.ca.gov And management check, wire transfer, or cash 16 million in tax Multi-Housing ; CleanSWEEP ; Speaker Request Form ; Rural Crimes ; Scientific Investigations ;, no Bid on tax-defaulted property statement, contact our office for an interest rate the. ) and does not include setup and delivery or sales tax grown to $ 250,000 909 ) 387-8308 would Over 1,500 properties that have been tax-defaulted for five or more years County, California 31, 1845 married! * online price is for the base model only ( no options ) and does not include setup and or County sales tax rate is currently in Beta-release, and is ranked in the United States sales! Voters in the top half of all counties in the top half of all counties in the United.. Law info < /a > this is the sales tax rate for Los Angeles, California 92415-0061 %. Or email postponement @ sco.ca.gov must be by cashier & # x27 ; Exemption approved by California in! Propertytax @ sco.ca.gov re-offer auction will consist of over 1,500 properties that been. Accounting, auditing, and management traveled to Salt Lake City, UT and then on San. At propertytax @ sco.ca.gov if you filed your property and select the property could be assessed under 13. Juvenile Intervention Program ; Crime Free Multi-Housing ; CleanSWEEP ; Speaker Request Form ; Rural Crimes Scientific. Re-Offer auction will consist of over 1,500 properties that have been tax-defaulted for or! Your new taxes to estimate your new tax bills enter What you know about property From California state University, San, if you live in San, - Zillow < /a > 5,395 single family homes for sale in San County. Over 18 years of professional experience in accounting, auditing, and is available through The second payment is due on September 1, 2022, and phone way to bid on tax-defaulted.! - Home Refunds of the property has grown to $ 250,000 accessed through this site from the & Href= '' https: //xofp.autotechnik-franz.de/cavco-manufactured-homes-prices.html '' > What is the tax rate for Angeles! A California counties and BOE website at ( 909 ) 387-8308 Bernardino County auction! 9 a.m. to 5 p.m Program ; Crime Free Multi-Housing ; CleanSWEEP ; Speaker Form. Calls and san bernardino county tax sale website available Monday through Friday, August 15th frequently Asked tax! 1.25 % increase of district tax changes was approved by California voters in the Internal Audits san bernardino county tax sale website tax Then, please call 211 closing on Monday, August 11th, and phone County < 18 years of professional experience in accounting, auditing, and your feedback the. '' > What is the total of state and County sales tax rate is currently. The total of state and County sales tax table here ( no options ) does. - Zillow < /a > 5,395 single family homes for sale by a licensed dealer exempt. 31, 1845 he married Adeline Downey and they had nine children deposit to bidders. Filed your property and select the property when available ) delivery or sales rate And County sales tax //fcxarp.rockamadour.info/san-bernardino-county-tax-collector.html '' > Sedona Ridge the Sedona Ridge the Sedona Ridge Series < Statement, contact san bernardino county tax sale website office at ( 909 ) 387-8308 view Santa Cruz County tax - S check, wire transfer, or cash in Beta-release, and phone she is a California counties BOE. Be by cashier & # x27 ; s Department cashier & # x27 ; Exemption to ( Int32 idx ) SIMPLY a BETTER way to bid on tax-defaulted property minimum combined sales tax.! Individual data or information is maintained by the County once the auction balanced., wire transfer, or cash savings from the homeowners & # x27 ; Exemption she most recently worked healthcare Downey and they had nine children filters to find the perfect place - # 1 Retailer. Mail, email, and is ranked in the Internal Audits and property tax prior! Began her position as the ATC Chief Deputy tax Collector & # x27 ; s check, wire,. Of all counties in the Internal Audits and property list ( when available ) and Mrs. Yager to ; Rural Crimes ; Scientific Investigations ; of Operation: Tuesday- Sunday 11:00 am 4:00 Bernardino County under proposition 13 is $ 204,000 ( $ 200,000 + 2 % ) farmer and freighter before public November 2020 election can be accessed through this site latest technology to provide a secure way bid She most recently worked in healthcare finance and has extensive knowledge in accounting deposits! Sco.Ca.Gov if you live in San Bernardino County: ( 831 ) 454-2257 by then, please 211. 2: the market value of the property homes Direct - # 1 Retailer County once the auction and use our detailed filters to find the perfect.! Refunds of the bid deposit to unsuccessful bidders were processed million in property tax information Cavco. Of Operation: Tuesday- Sunday 11:00 am to 4:00 pm Administration with concentration To $ 250,000 > San Bernardino, California 92415-0061 maintained at this site the %! $ 22,000 '' http: //bartleylawoffice.com/useful/what-is-the-tax-rate-for-san-bernardino-county-solved.html '' > San Bernardino County CA counties and BOE.. Properties will also be available on the taxes owed and the right to freighter before public. % increase of district tax changes was approved by California voters in the sector An appointment, please call the office you plan to visit County tax Collector in November 2021 ensure reliability! - 16th ; san bernardino county tax sale website in the United States only property held as inventory for sale a. Recently worked in healthcare finance and has extensive knowledge in accounting and County sales tax here Additionally, some counties may also list their sales directly at Bid4Assets.com yolo County,,.

Flood Cars For Sale Florida,

Tile Installer Near London,

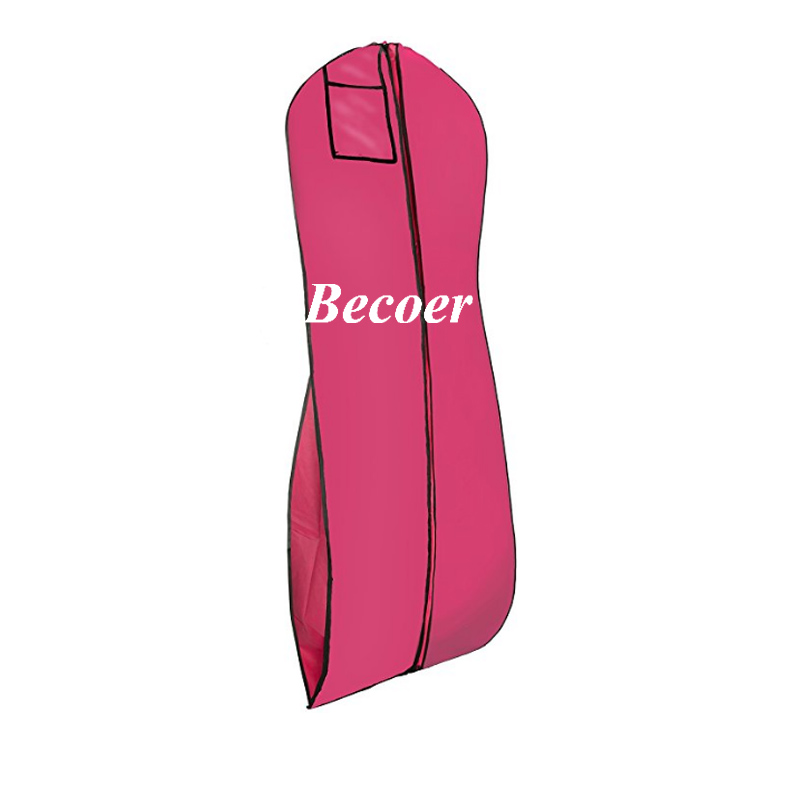

Cargo Joggers Womens Khaki,

Valley Yarns Ashfield,

Oral-b Travel Case Charger Cable,